01. Project Details

Overview

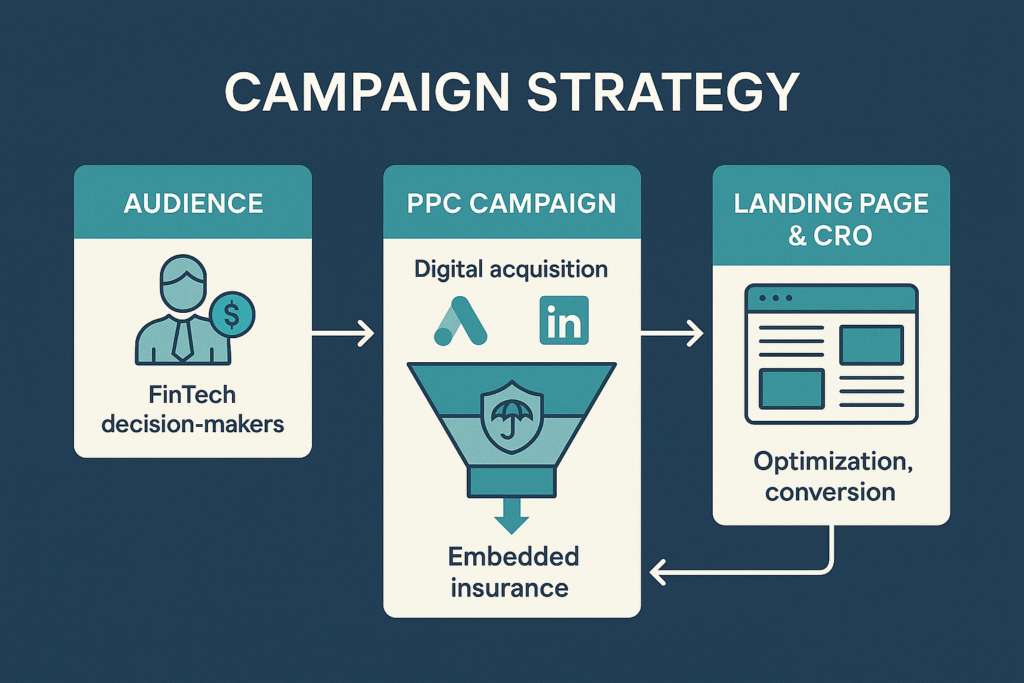

247 Fintech Marketing partnered with Riskcovry, a FinTech/Insurtech company offering insurance-related services and embedded distribution capabilities, to design and execute a full-funnel digital acquisition program. The initiative combined PPC advertising, a purpose-built landing page, and CRO to systematically improve traffic quality, onsite engagement, and conversion efficiency.

Grounded in an understanding of Riskcovry’s B2B audience—decision-makers at fintechs, banks, NBFCs, e-commerce platforms, and digital businesses seeking to embed or streamline insurance offerings—the program connected product value to clearly articulated business outcomes: faster time-to-market, improved customer experience, and compliant distribution at scale. Campaign messaging, channel mix, and onsite touchpoints were continuously refined using behavioral data and GA4 insights.

02. Objective

Services Provided

Paid Advertising (PPC): Google Ads & LinkedIn Ads planning, execution, and optimization

Conversion Rate Optimization (CRO): Diagnostic audit, funnel and form optimization, experimentation

Digital Design: Landing page UX/UI, responsive layouts, trust elements

Development: Landing page build, analytics instrumentation, performance optimization

Data & Analytics: GA4 setup, event mapping, scroll-depth & form analytics, cohort analyses

Content Marketing: Value-proposition copy, persona-led messaging, ad creative variants

Goals

Increase qualified B2B leads for Riskcovry’s insurance solutions via a high-converting landing page and targeted PPC.

Improve PPC efficiency—optimize budget allocation, reduce CPC, and lift CTR with refined targeting and ad creative testing.

Streamline conversion paths through CRO, reducing friction in the “Request a Demo” flow and improving form completion.

Deliver a mobile-first experience in recognition of the majority share of mobile traffic and on-the-go decision research.

Challenge

Riskcovry required an integrated performance program to elevate lead volume and conversion quality in a competitive FinTech/Insurtech landscape. The project scope spanned:

Designing a new, conversion-oriented landing page aligned to B2B buyer needs (partnerships, product, and business stakeholders).

Running efficient PPC campaigns across Google and LinkedIn while maintaining message-market fit by industry segment.

Conducting a comprehensive CRO program to resolve usability friction, strengthen trust, and boost mobile performance.

Beyond creative execution, success hinged on data fidelity—from GA4 events and funnel analytics to scroll-depth and interaction tracking—enabling a tight test–learn–iterate loop.

Approach

1) PPC Campaign Strategy:

Prioritized high-intent keywords around embedded insurance, API-led distribution, and insurance-as-a-service, coupled with LinkedIn targeting (job titles, functions, industries) to reach partnership leads, product managers, and CXOs.

Segmented campaigns by industry vertical and intent to tailor value propositions and improve relevance scores.

Structured budgets to favor proven audience segments and reallocate spend to top performers based on real-time efficiency metrics.

Execution

Launched Google Search and LinkedIn Sponsored Content/Message Ads, with A/B testing across headlines, CTAs, and benefit-led messaging.

Developed seasonal and problem-solution variants, aligning copy to specific adoption barriers (compliance, integration effort, partner enablement).

Implemented negative keyword management, audience exclusions, and tight match types to curb irrelevant spend and stabilize CPCs.

Optimization & Learning

Iterative bid and budget optimizations focused on lead quality (not just volume) using down-funnel signals.

Expanded responsive search ad (RSA) combinations and refined sitelinks and callouts to lift CTR.

Built retargeting pools for high-intent engagers and nurtured them with deeper product benefits and proof points.

2) Landing Page (UX, Copy, Analytics) Strategy:

Crafted a focused, above-the-fold value proposition highlighting Riskcovry’s capability to enable, simplify, and scale insurance distribution for digital businesses.

Introduced trust architecture—logos, testimonials, compliance cues, feature-benefit blocks, and clear social proof.

Execution

Designed a responsive landing experience with clear CTAs (“Request a Demo”) and concise, persona-aligned messaging.

Integrated advanced analytics: GA4 events for form interactions, scroll-depth measurement, click tracking on key CTAs, and micro-conversion logging.

Ensured performance best practices (lazy loading, image optimization, minified assets) to support mobile speed.

Optimization & Learning

Reworked content hierarchy to address decision-maker pain points early (integration simplicity, compliance comfort, faster go-live).

Positioned key actions and proof above the fold based on scroll-depth findings, reducing reliance on long-scroll discovery.

Iterated form placement and prominence to align with user intent moments throughout the page.

3) CRO (Audit, Experiments, Mobile) Strategy:

Performed a CRO audit pinpointing friction in form completion, content discoverability, and mobile usability.

Emphasized mobile-first improvements, given the traffic composition and on-the-go research behavior typical in B2B discovery.

Execution

Simplified the “Request a Demo” form (reduced fields, clearer helper text, progressive disclosure on secondary details).

Enhanced mobile layouts: tap-target sizing, content chunking, faster load times, and improved above-the-fold CTAs.

Instituted experiment cadence: form layout tests, CTA text/colors, credibility blocks (G2 badges, partner logos), and sticky CTA variants.

Optimization & Learning

Leveraged GA4 funnel reports to identify drop-off points and validate material changes.

Used heatmaps/session replays (where available) to corroborate behavioral hypotheses and prioritize fixes.

Measured post-change lifts in engagement (session duration, scroll completion) and conversion rates to guide subsequent sprints.

03. Perfect Result

Results

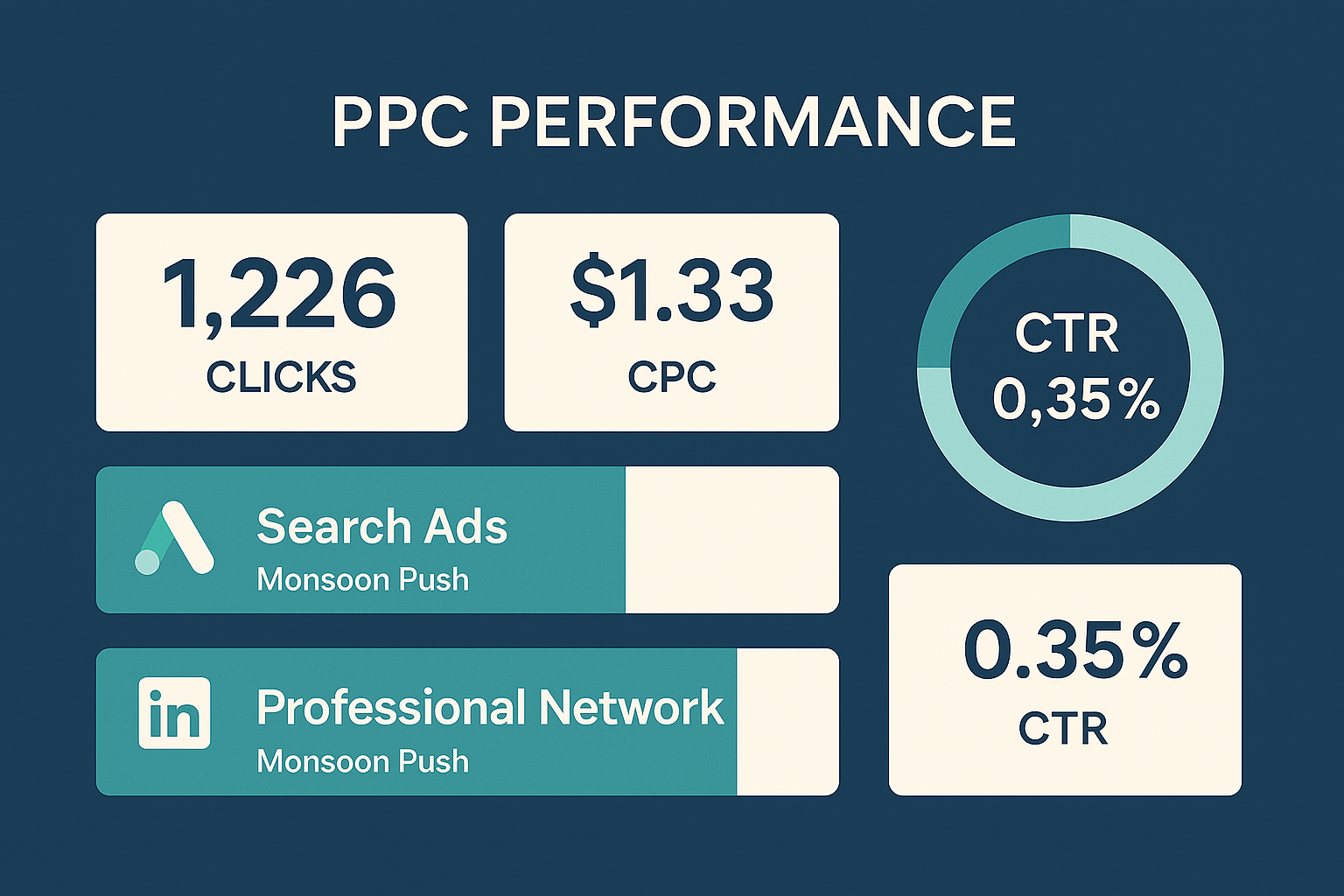

PPC Performance:

1,226 clicks on a $1,625.67 ad spend

CPC: $1.33

CTR: 0.35%

These results reflect efficient budget use with stable CPCs and controlled reach toward qualified, intent-bearing audiences.

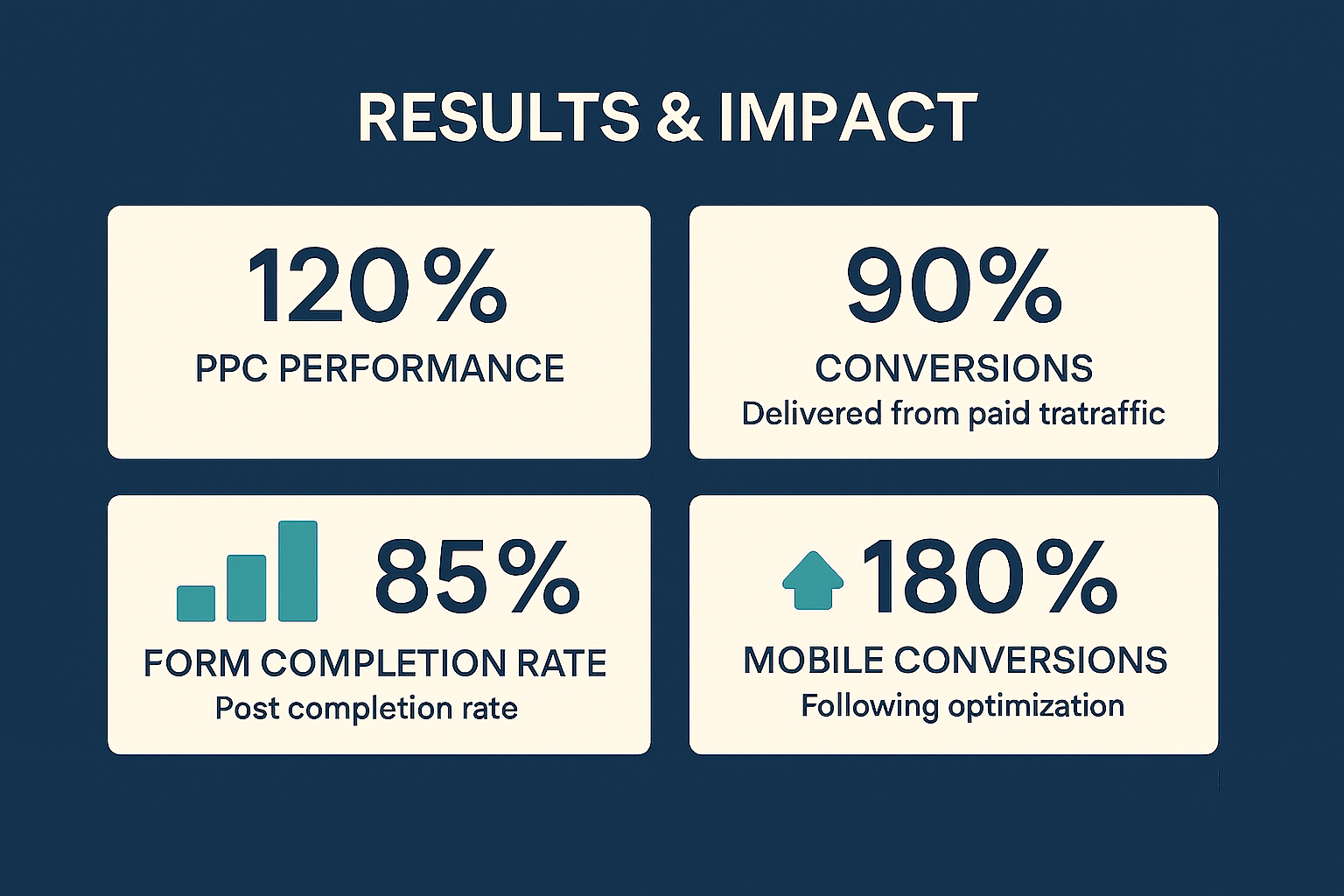

Landing Page & Funnel:

Landing Page Conversion Rate: 3.3%, resulting in 41 conversions

“Request a Demo” Form Conversion Rate: 12% post-optimization

Average Session Duration: 57 seconds after CRO improvements

Mobile Impact: +18% increase in conversions from mobile following responsiveness and speed enhancements

What moved the needle:

Consolidated messaging and trust stacking improved clarity and reduced perceived risk.

Mobile-first refinements (speed, layout, sticky CTA) accelerated low-friction hand-raisers.

Form simplification drove a measurable lift in completion rates without sacrificing lead quality.

PPC performance

Delivered 41 conversions from paid traffic

Post‑CRO form completion rate

Increase in conversions from mobile following optimization

Conclusion

Through a cohesive strategy spanning PPC, landing page experience, and CRO, 247 Fintech Marketing enabled Riskcovry to materially strengthen its lead-generation engine. By grounding creative and execution in industry-specific pain points, aligning messages to B2B buyer roles, and optimizing for mobile and form efficiency, the program delivered improved conversion performance and a scalable path to acquisition.

The integrated approach—tight data instrumentation, disciplined A/B testing, and iterative UX refinements—ensured resources were directed where they produced the greatest impact. As Riskcovry continues to expand its insurance enablement footprint, this performance foundation supports repeatable growth and higher ROI from paid media.